Illness and Bad Investments Wreck Couple’s Plans, but Recovery Possible

Andrew Allentuck

Situation: Crippling illness, huge drug bills and failed investments cloud couple’s future

Solution: High savings rate and good prognosis make financial and physical recovery possible

When Alex loses his job in his mid-fifties, he and his wife realize they can’t live a six-figure lifestyle on a five-figure income. Read on

Financial plans that depend on years of work and saving can be wrecked by illness. Take an Alberta couple we’ll call Ken, 42, and Wilma, 44.

Competitive cross-country and downhill skiers, they generated an income edging into six figures until, just six months ago, Ken, who works for a large transportation company, began to suffer from a hard to treat neuromuscular disease.

Formerly an outdoorsman seemingly cut out for rugged work, he now has trouble walking. His career is in shambles. Without treatment, he cannot work. With treatments, which have not been covered by medical or drug insurance, his financial life is in shambles.

Treatment for the illness costs $1,500 a month for a drug neither the provincial health plan nor his private health insurance would cover for many months. The insurers’ view, according to Wilma, is that the costly drug produced in small amount is experimental and perhaps ineffective. Though a modest payment has been made by the insurer, Ken continues to pay the bills out of savings and family income reduced by his inability to work.

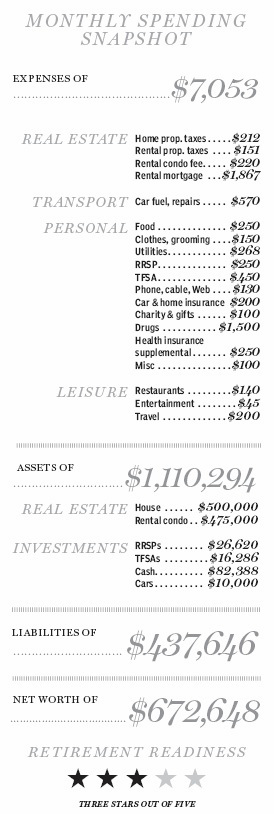

The drug bill and the private medical plan which costs another $250 a month on top of the monthly pharmacy tab consumes a quarter of the couple’s $7,053 monthly take home income, 60% of which is generated by Wilma’s job as a manager for a charity.

Family Finance asked Derek Moran, head of Smarter Financial Planning Ltd. in Kelowna, B.C., to work with Ken and Wilma. “This case is about financial survival in the midst of health concerns. Sudden illness has devastated their retirement plans. For now, with their income slashed by inability to work, they need to be able to rebuild their financial future.”

Ken and Wilma have some good things going for them. Ken’s company continues to pay him two-thirds of his salary. Through tax credits and deduction of his large drug costs, he pays a tax rate of no more than 1% of his gross income.

The Investment Problem

Ken and Wilma have two real estate properties: their mortgage-free $500,000 home, and a rental property with a current market value of $475,000 for which they paid $721,000 in 2009. The price crumbled when the developer, stressed with his own finances, chopped prices for unsold units in their complex, undercutting existing owners to save his own skin.

The rental property generates rents of $19,200 a year, from which they deduct $1,812 annual real estate taxes and $2,640 condo fees for net rent of $14,748 a year. Take off $14,442 interest (this does not include payment toward equity; total monthly payment is $1,867) and net income is just $306 a year. That’s less than 1% return on equity, which is simply dismal.

They could sell the property, take the loss of $246,000 or perhaps more after selling costs and mortgage prepayment. Or keep the property and hope for an eventual capital gain while the property revenue pays down the mortgage. The latter is probably the better choice if Ken and Wilma have the patience and stomach for it, Mr. Moran says.

Planning Retirement

Ken’s prospects for returning to work are relatively good, for his condition is being treated. Odds are that Ken will recover, return to work, gain the third of his salary not currently being paid, and be able to avoid the complex process for gaining formal disability status.

Ken’s present medical problem has hampered his work for six months. Assuming, further, that he can continue to work in some capacity at his present full time wage of $52,000 a year until age 65, he can count on Canada Pension Plan benefits of $12,460 a year at age 65. Wilma will also be able to receive the same maximum CPP benefit at her age 65. At 67, each will have Old Age Security benefits, currently $6,618 a year in 2014 dollars.

The couple has $26,620 in RRSPs. Wilma has $78,000 of RRSP contribution room. They have over $82,000 of cash, most of which is reserved for paying the drug bills. But the drug cost should decline and their cash and monthly savings after the drug bills stop will be available for shifting to RRSPs.

Wilma should contribute enough dollars each year to her RRSP. If she adds $935 a month, just a part of what they now pay for drugs, for the next 21 years, when Wilma will be 65 and Ken 63, and if their RRSPs generate 3% after inflation, they will have $380,000 in 2014 dollars. If paid out entirely so that all savings are gone by Wilma’s age 95, the capital would generate annual income of $18,820.

In their TFSAs, currently $16,286, if they continue to contribute $5,400 a year and get 3.0% after inflation, would have $190,000 when Wilma is 65. That sum would generate $9,411 if paid out to exhaust capital to her age 95. Their rental property, with its mortgage paid off, would generate $14,748 in 2014 dollars.

Finally, there is Ken’s pension. If he continues to work at his $51,670 salary projected to retirement for use in calculating the retirement pension, then, at retirement, he could expect $370 a month at 65.

Adding up the elements of their retirement income, they would have $24,920 in combined CPP benefits assuming they take them when each is 65. They would have rental income of $14,748 a year. They would have RRSP income of $18,820 a year. Their TFSAs would pay $9,411 to Wilma’s age 95. Ken would have a pension at 65 of $4,440.

At 67, each could receive Old Age Security which, at 2014 rates, is $6,618 a person a year. Thus at 67, total retirement income would be $84,575 before tax or, with pension splitting and applicable tax credits and an average tax rate of 15%, they would have $5,990 a month to spend. Without mortgage paydown costs, RRSP and TFSA savings, they would have expenses of $4,486 a month. With drug costs eliminated, they would need only $2,986 a month. They could ski without worries.

“This case has a lot of unknowns, mainly the timing of Ken’s recovery,” Mr. Moran says. “On the upside, the couple has paid off their house and they save diligently. Their savings give them the ability to deal with the financial consequences of Ken’s health issues.”

(C) 2014 The Financial Post, Used by Permission