Optimism #66 - August 11th 2023

Dear clients and friends,I’m bored. Stocks haven’t done much for nearly two years. It’s like waiting for the kettle to boil. Dividends roll in but that’s about it. Bonds are maturing and new interest rates are higher, but we don’t see the higher payments yet as they only pay once or twice a year. News is bleak. Investors are questioning their strategies. Japan seems to be doing well, as are a few growth names. Most professionals and consumers are negative in their perspective, or they are at the cottage.

On the bright side, recent dividends from Power Corp, TD, CP rail, TC Energy, CIBC, Scotiabank, Couche Tard, Emera, and Telus means there is food in the fridge and wine in the cellar.

It’s difficult to know who to believe. People like Jurien Timmer, Fidelity’s top guy, and Larry Fink, top at Blackrock, are optimistic.

Other very bright and well-informed people such as Dave Rosenberg, Bob Tattersall and George Athanassakos are pessimistic.

I have no idea. Time is our friend so I keep telling myself that the short-term gyrations don’t matter.

It’s always positive to see insiders buying at Baytex Energy, Transcanada Pipeline, New Found Gold, Artemis Gold and Tourmaline Oil.

Another good sign, dividend increases in July from Storage Vault and TMX Group.

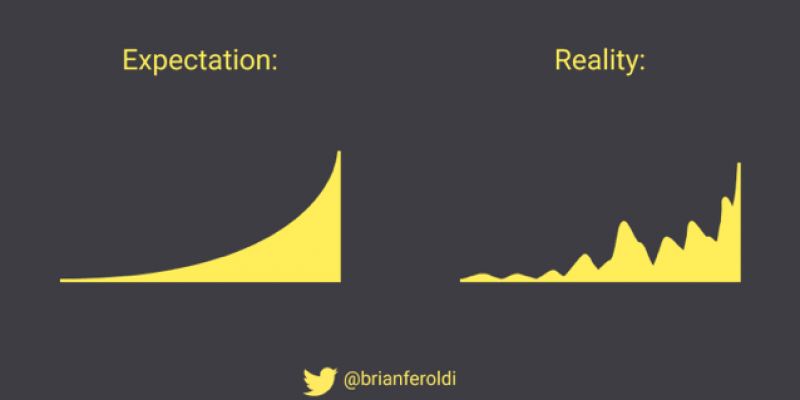

I like this picture. Courtesy of Brian Feroldi on Twitter:

I take a fair amount of heat from investment pros for my Canadian investment bias. This article looks at both sides.

They say “What global diversification can do is to protect you from long dry spells in your local market" Doesn’t the dividend income protect us somewhat? (I feel that it does.) File attached

Thank you to another Brian for the article on how our financial literacy appears to decline with age. Interesting stuff. File attached as well. Maybe those managing their own should be letting go of the reins at a certain age?

Here is a link to an article by Gordon Pape, about how excellent income yields are available to investors, but are unlikely to remain so for long. He mentions GICs, high interest savings accounts and dividend stocks. For such rates to disappear, interest rates have to fall and stock prices have to rise… both positive. File attached

Oil and natural gas prices are up. It’s bad for people that drive a lot, but good for Canada’s economy, especially Western Canada’s.

With higher interest rates than we’ve seen in twenty years, it’s time to talk about annuities. I have a situation I would like your opinion on. We have a 75-year old female, single, no kids, can pay $250,000 of RRIF money to a life insurance company in turn for ~$2,000 per month of income for life, no matter how long she lives. Should she do it?

Annuity payments are not indexed to inflation. If inflation remains high, the value of the payment stream will be eroded.

Ignoring interest, it would take 10.42 years to get her principal back. Or put another way, if she dies at age 85, she will have achieved a rate of return of 0%.

If she invests the money instead, withdraws the same amount and it grows at 6%, it will run out in April of her 90th year.

If she lives to age 95, she will have achieved a return of 8.27%.

Having no children or spouse, we elected the zero years of guaranteed payments option, or zero survivor benefit. If she dies the day after buying the annuity, it all goes to the insurance company.

Should she buy the annuity? I welcome your thoughts.

Derek Moran